The Chinese Shanghai Composite Index has now recorded four consecutive down-weeks. The Index witnessed another massive sell-off on Monday, declining by a further 6.7% to take its total loss since the peak of August 4 to 23.2%.

The losses happened on concerns of large Chinese share issuance and slowing bank lending. The banking regulator has already instructed lenders to raise reserves to 150% of their non-performing loans by the end of this year -- up from 134.8% at the end of June -- and the central bank has increased money-market rates to drain liquidity.

China, could be the catalyst for triggering a reversal of fortune in global stock markets.

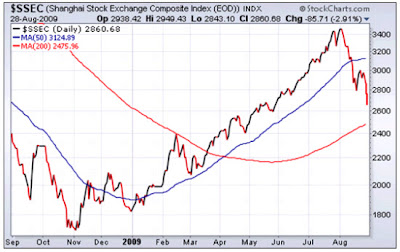

Of the global stock markets I monitor, the Shanghai Composite (2,667) is the only one to have breached its 50-day moving average (3,125) and now has the key 200-day line (2,476) firmly in its sight.

Interestingly, emerging markets have now seen two back-to-back weeks of declines and have been underperforming developed markets for four weeks running, as shown by the declining trend of the MSCI Emerging Markets Index relative to the Dow Jones World Index. Could this be a sign of a broad retrenchment in risk appetite?

A global stock market correction could take the form of either a pullback or a consolidation (i.e. ranging). I suspect we may see at least some degree of reversion to the 200-day moving averages in a number of instances, but I'll be watching closely to ascertain whether we're dealing with a normal short-term correction or a more significant move threatening the primary trend. In the meantime, sit tight and be cautious as markets hopefully realign with the reality on the ground.

1 comment:

I am convinced that there will be 2-3 weeks small upward waves from next week before the October Dip.

As for China, it is a closed market with nervous investors. The market maker is in rule. As such, it can still hold its water because of "FACE"....

I will long on Gold and short on USD.

Post a Comment