Saturday, September 26, 2009

JAPAN, Will Drive US Interest Rates Up!

Friday, September 25, 2009

Life After The Autumnal Equinox.

Wednesday, September 23, 2009

The Writing Is Already On The Wall.

After this recent 68.5% move up in the NASDAQ from the March lows, and a 47.5% rally in the Dow Jones Industrial Average (DJIA), this is the question that's on every investor's mind.

To answer it, we must look back in history to crashes comparable to the one we just experienced from the October 2007 highs to the March 2009 lows, a fall of over 50% on DJIA, NASDAQ, and the SP500. Similar periods would be the famous 1929 crash, and the crashes of 1973-74 and 1987.

The Good

In a Clint Eastwood analogy of The Good, The Bad, and The Ugly, there are no "good" crashes, only "good" bull markets that eventually follow. On that hopeful note, let's move on to the bad and the ugly.

The Bad

The 1987 crash with its comparatively modest 36% decline, while not good, was the least bad or ugly of those we'll now look at. It was of such short duration and recovered so quickly that this severe correction isn't nearly as good a "comp" to our present market as "the bad" and "the ugly" crashes of 1929, 2000, and 1974.

When we look at today's powerful 68.5% rally in the NASDAQ, the DJIA of 1974-75 comes to mind. After the DJIA crashed 44.5% between January 11, 73 and October 4, 1974, it rallied a comparable 73.5%. It’s possible that our current rally in the NASDAQ could turn out to be greater than the 1975 DJIA rally because the current NASDAQ had a much worse collapse of 55.5%.

In the past, the DJIA was the proxy for "the marketplace." Many believe that today's NASDAQ has assumed that role, and that it's the more accurate representation of today's overall economy. If that's so, when the NASDAQ finally ends its current powerful rally, we may very well see a series of corrections and rallies such as those that took place in the DJIA between 1975 and 1982, when a new secular bull market was born.

Indeed, a strong case can be made that the true high of our markets was put in with NASDAQ 2000 bubble high, and the first of the crash and rally intervals took place beginning with the crash of 2000-02. The roller coaster sequence of 2000-02 crash, 2002-07 rally, 2007-09 crash, and the current rally of 2009, may indeed be the proof that we're in such a period. Six more years of crashes and rallies doesn't bode well for those investors still faithful to the philosophy of "buy and hold."

The Ugly

When we compare the chart of our current market to that of the 1929 crash, we'll see that they're strikingly similar. The 1929 rapid 48% collapse of the DJIA in 1929, although much briefer in duration, produced a similar price pattern to that of the slow-motion crash in 2008. The total collapse of 53% from the October 2007 closing high to the March 2009 low was much worse than the 1929 crash. Our recent rally of 47.5% since March in the DJIA has been virtually identical to the five-month, 48% rally which followed the 1929 crash.

What happened after the 1929 rally was simply horrific. The DJIA quickly tanked 26%, and by July of 1932, ultimately collapsed by a total of 86%. If our current market continues to follow the 1929-32 pattern, the DJIA should move quickly back to 7200 and finally to a low of 1400 in early 2012. Should this scenario play out, "buy and hold" investors will simply be destroyed. Following the Great Depression, the DJIA didn't return to its 1929 highs until 1954. Using history as a guide, today's “buy and hold” investors who bought in 2007, can look forward to breaking even some time in 2032.

The Outlook Based On History

Ironically, today's DJIA seems to be repeating the DJIA 1929-1932 collapse, as the NASDAQ appears to be repeating the movement of the DJIA 1973-82 roller-coaster period. The conclusion to be drawn here is that we're in a bear market similar to both 1930s and 1970s; one that will be both "bad" and "ugly."

I encourage "buy and hold" investors to take full advantage of this bear market rally and protect the gains that have been achieved since the lows of March. I believe that this current rally should be considered a "gift from ALLAH," sold in order to raise cash, especially in front of October.

Imagine how investors in 1932 must have felt; having held their stock all the way down, they must certainly have looked back at the 1929-30 rally as a great opportunity lost. Simply stated, for at least several years, it's time to move away from buy-and-hold investing by buying low and selling high. Whether you're a trader or an investor, in light of the magnitude of this current rally, you need to be prepared for a potential downside reversal as we enter October -- historically the most famous month for market crashes.

The bottom line is this: The easy money has been made in this rally. I believe that we're nearing the time to "sell high," as this current rally begins to roll over into a downward move of considerable magnitude.

The caveat is this: Once you're off a galloping horse, it's very difficult to get mounted again. So be disciplined in how you begin to take profits and ultimately get short this market.

Think fast... get out now!

Monday, September 21, 2009

The Looming Trade War.

US stock markets have had a very wobbly opening last Monday as fear spreads that the Obama administration has fired the first salvo in a trade war with China.

President Barack Obama made a long-awaited decision on previous Friday about imposing sanctions on China over alleged"dumping"of low-cost tires on the American market. Obama sided with trade unions and imposed stiff duties on $1.8 billion worth of Chinese tire imports.

The United Steelworkers brought the case against China back in April, claiming that more than 5,000 tire workers had lost their jobs since 2004 because of cheap Chinese tires flooding the US market.

Obama's order raises tariffs on Chinese tires for three years -- by 35% in the first year, 30% the second, and 25% the third.

The Chinese government hit back fast, and on many fronts.

On Sunday, Beijing announced it would investigate complaints that American auto and chicken products are being dumped in China or that they benefit from subsidies. China says the US imports have "dealt a blow to domestic industries" and you can be sure Beijing won't have much trouble arguing that US farmers and automakers are heavily subsidized.

On Monday, Beijing escalated its action with a complaint to the World Trade Organization (WTO). The Chinese complaint in Geneva triggers a 60-day process in which the two sides will try to resolve the dispute through negotiations. If that fails, China can request a WTO panel to investigate and rule on the case.

With unusually swift and coordinated action, the official Xinhua new agency quoted the government as saying, "China believes that the action by the US, which runs counter to elevant WTO rules, is a wrong practice abusing trade remedies."

So far, it's a trade spat, not a war. But it's an irritant as Washington and Beijing prepare for a summit of the Group Of 20 leading economies in Pittsburgh on Sept. 24. Obama is set to visit Beijing in November, and his reception could be very frosty.

Amazingly, American tire companies had begged the president not to go ahead with sanctions against China. "By taking this unprecedented action, the Obama administration is now at odds with its own public statements about refraining from increasing tariffs" said Vic DeIorio, executive vice president of GITI Tire in the US. "This decision will cost many more American jobs than it will create." GITI Tire is the largest Chinese tire maker, and a US retailer of low-cost imports.

Although investors are not yet facing World War III between the two economic superpowers, it's enough to make the markets very nervous. The Chinese ADR Index tumbled heavily at the markets' opening, but recovered swiftly as cooler heads prevailed.

Alarmists are worried that China, which holds about a trillion dollars worth of US financial instruments, could declare a real economic war. The tools Beijing could use are worrisome. China could: -

1. Sell dollars it holds faster than it already is

2. Not buy at the treasury auctions in the near future

It's a little too early for China to exercise the nuclear option in this trade dispute, but the events have spread fear in otherwise buoyant markets. Investors in US stocks should exercise caution and consider diversification as worries about the US dollar's devaluation, inflation, and trade wars continue to loom.

Holders of Chinese ADRs should ride out this rough period if they're confident that the shares they hold are from companies which continue to grow profits by double digits.

And, more importantly, they shouldn't be invested in companies dependent on foreign exports.

Saturday, September 12, 2009

Is The S&P Finally Burning Out?

Thursday, September 10, 2009

Wats Affecting Your Trading ?

Kalama Sutra - Angutarra Nikaya 3.65

Teaching given by the Boot-der given to the Kalama people:

Tuesday, September 8, 2009

Do You Remember.. The Twenty-First Night Of September..?

-The post-monsoon wedding season begins in India.

-The Indian festival season begins.

-American jewelers begin restocking in advance of Christmas.

-Ramadan ends in late September in the Muslim world with a period of celebration and gift-

-And, in China, the week-long National Day celebration starts October 1. Already in China, gold jewelry demand increased 6% in the second quarter.

While just about everyone in the world is getting ready to celebrate, the price of gold (charts courtesy of stockcharts.com) is getting ready to perform its own celebration dance.

Saturday, September 5, 2009

Staying LONG On SPDR Gold Trust ETF (GLD).

Tuesday, September 1, 2009

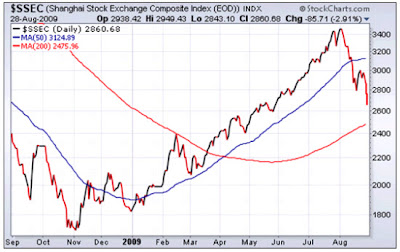

When Shanghai Cracks.