GREED.. FEAR.. NO LIMITS.. NO REGRETS.."a-man". Deze tijd, Wij zijn niet komend van de zee!

Einhorn added, "Prospectively, gold should do fine unless our leaders implement much greater fiscal and monetary restraint than appears likely. Of course, gold should do very well if there is a sovereign debt default or currency crisis."

David Rosenberg, chief economist and strategist at Gluskin Sheff, also continues to favor gold. The fact that the yellow metal continues to surge higher -- even with ongoing deflationary developments -- suggests that other factors are driving bullion to new bullish heights, he says.

"It's called scarcity of supply relative to fiat currency, "Rosenberg argues.

The strategist wrote today in a research note that he thinks gold can at least double if not triple from here.

"The cup is still half full -- and still can be filled with gold eagle coins," he said.

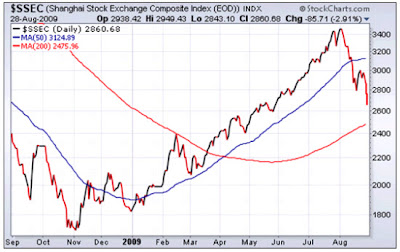

In a Clint Eastwood analogy of The Good, The Bad, and The Ugly, there are no "good" crashes, only "good" bull markets that eventually follow. On that hopeful note, let's move on to the bad and the ugly.

The Bad

The 1987 crash with its comparatively modest 36% decline, while not good, was the least bad or ugly of those we'll now look at. It was of such short duration and recovered so quickly that this severe correction isn't nearly as good a "comp" to our present market as "the bad" and "the ugly" crashes of 1929, 2000, and 1974.

When we look at today's powerful 68.5% rally in the NASDAQ, the DJIA of 1974-75 comes to mind. After the DJIA crashed 44.5% between January 11, 73 and October 4, 1974, it rallied a comparable 73.5%. It’s possible that our current rally in the NASDAQ could turn out to be greater than the 1975 DJIA rally because the current NASDAQ had a much worse collapse of 55.5%.

In the past, the DJIA was the proxy for "the marketplace." Many believe that today's NASDAQ has assumed that role, and that it's the more accurate representation of today's overall economy. If that's so, when the NASDAQ finally ends its current powerful rally, we may very well see a series of corrections and rallies such as those that took place in the DJIA between 1975 and 1982, when a new secular bull market was born.

Indeed, a strong case can be made that the true high of our markets was put in with NASDAQ 2000 bubble high, and the first of the crash and rally intervals took place beginning with the crash of 2000-02. The roller coaster sequence of 2000-02 crash, 2002-07 rally, 2007-09 crash, and the current rally of 2009, may indeed be the proof that we're in such a period. Six more years of crashes and rallies doesn't bode well for those investors still faithful to the philosophy of "buy and hold."

The Ugly

When we compare the chart of our current market to that of the 1929 crash, we'll see that they're strikingly similar. The 1929 rapid 48% collapse of the DJIA in 1929, although much briefer in duration, produced a similar price pattern to that of the slow-motion crash in 2008. The total collapse of 53% from the October 2007 closing high to the March 2009 low was much worse than the 1929 crash. Our recent rally of 47.5% since March in the DJIA has been virtually identical to the five-month, 48% rally which followed the 1929 crash.

What happened after the 1929 rally was simply horrific. The DJIA quickly tanked 26%, and by July of 1932, ultimately collapsed by a total of 86%. If our current market continues to follow the 1929-32 pattern, the DJIA should move quickly back to 7200 and finally to a low of 1400 in early 2012. Should this scenario play out, "buy and hold" investors will simply be destroyed. Following the Great Depression, the DJIA didn't return to its 1929 highs until 1954. Using history as a guide, today's “buy and hold” investors who bought in 2007, can look forward to breaking even some time in 2032.

The Outlook Based On History

Ironically, today's DJIA seems to be repeating the DJIA 1929-1932 collapse, as the NASDAQ appears to be repeating the movement of the DJIA 1973-82 roller-coaster period. The conclusion to be drawn here is that we're in a bear market similar to both 1930s and 1970s; one that will be both "bad" and "ugly."

I encourage "buy and hold" investors to take full advantage of this bear market rally and protect the gains that have been achieved since the lows of March. I believe that this current rally should be considered a "gift from ALLAH," sold in order to raise cash, especially in front of October.

Imagine how investors in 1932 must have felt; having held their stock all the way down, they must certainly have looked back at the 1929-30 rally as a great opportunity lost. Simply stated, for at least several years, it's time to move away from buy-and-hold investing by buying low and selling high. Whether you're a trader or an investor, in light of the magnitude of this current rally, you need to be prepared for a potential downside reversal as we enter October -- historically the most famous month for market crashes.

The bottom line is this: The easy money has been made in this rally. I believe that we're nearing the time to "sell high," as this current rally begins to roll over into a downward move of considerable magnitude.

The caveat is this: Once you're off a galloping horse, it's very difficult to get mounted again. So be disciplined in how you begin to take profits and ultimately get short this market.

Think fast... get out now!